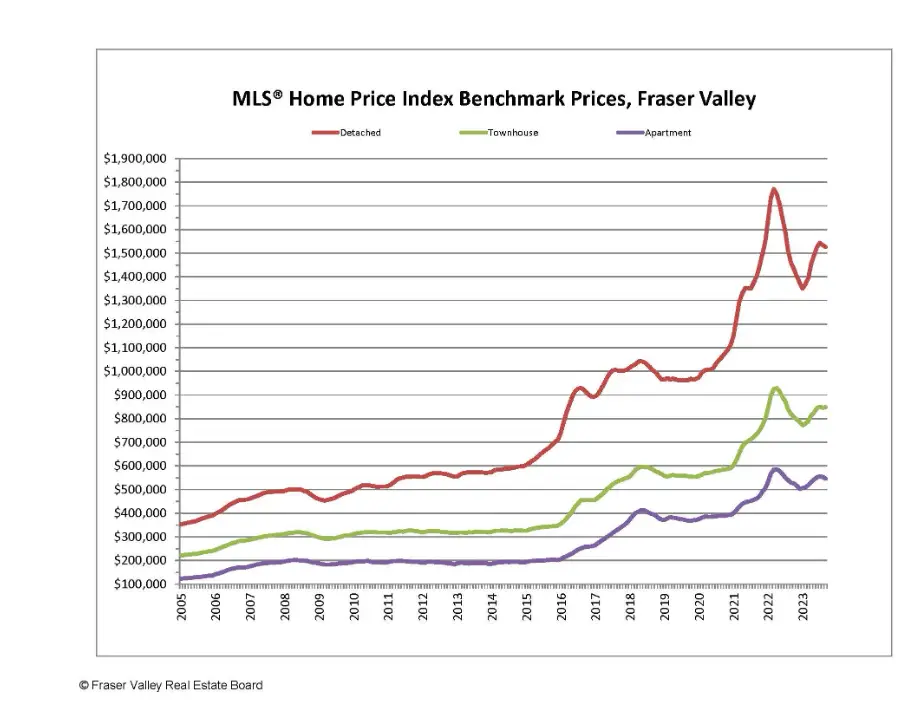

PRICES ARE DROPPING

The real estate market has been on a roller coaster ride this year. Buyers flooded the market when the Bank of Canada paused interest rate increases in March, however, that pause didn’t last long. The Bank of Canada raised the policy rate again in June and July, which eventually brought sales down to near-historical lows again. The Bank’s policy rate now sits at 5% which is an increase of 4.5% since Feburary 2022. The next interest rate announcement is October 25.

As of September 2023, the inflation rate is sitting around 3.8%. The Bank projects that inflation will stay around 3% for the next year, returning to the 2% target by the middle of 2025. If this projection holds true, the Bank may not decrease the policy interest rate until late 2024. This situation will prove problematic for many home owners that have mortgages coming up for renewal in the next year. There could be a significant increase in new listings from owners looking to downsize their mortgage.

Greater Vancouver MLS® HPI Benchmark Price Activity

•Single Family Detached: At $2,017,100, the Benchmark price for a single-family detached home decreased 0.1% compared to August 2023 and increased 5.8% compared to September 2023.

•Townhomes: At $1,098,400, the Benchmark price for a townhome decreased 0.5% compared to August 2023 and increased 5.3% compared to September 2022.

•Condos: At $768,500, the Benchmark price for a apartment/condo decreased 0.5% compared to August 2023 and increased 5.8% compared to September 2022.